I have (for a very long time) said that angel networks in India are in a deadly spiral. I had not (yet) discovered “why” angel networks are no longer viable for investors or the founders of the angel networks.

The issue lies in the fact that India’s angel networks no longer operate as networks. The significant shift took place almost 8 years ago when networks decided to become “for-profit.” An event that Anil spoke about in DamaniTalks Episode XV:

Running a successful angel network or making profits while running an angel network is a paradox. In their purest sense, Angel networks get defined as a group of angel investors who have organized to invest collectively, operate more effectively, and provide mutual support.

The key phrase here is that the angel investors have organized to invest collectively, operate more effectively, and provide mutual support; therefore, the underlying expectation is that the network will not profit from its members’ investment activities. The angel network team is merely a facilitator serving its members. The team must not spend more than what its members are willing to add to their investment costs, and members must have a say in how their money gets spent.

Another expectation from an angel network is that the investors are known to each other. Therefore, an angel network’s value gets derived from its cohesiveness – not the number of people in that network.

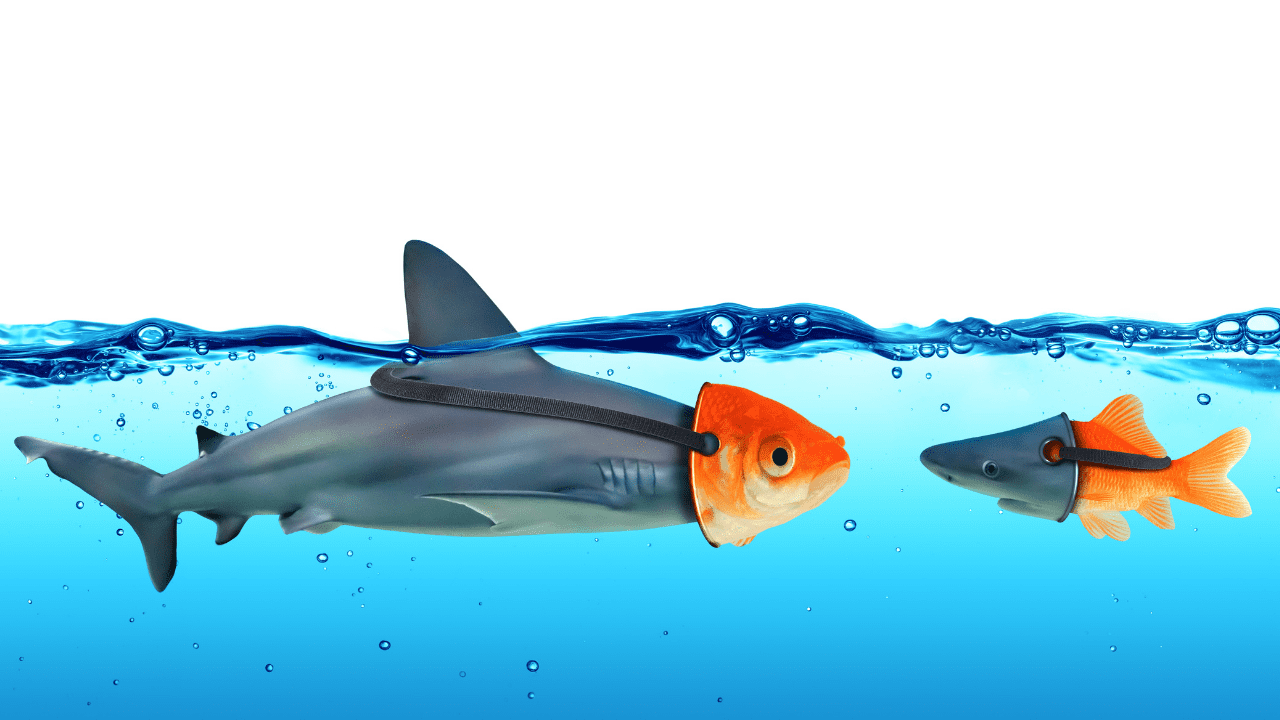

When a 3rd party tries to bring people who are (mostly) unknown to each other into a single investment, the 3rd party does not substantially sum their money into these startups – they are a service provider or an investment platform but not an angel network.

The for-profit platform attempts to get its revenues through these means (some, if not all):

- Annual membership fees to its members

- Per-deal fee from members (usually 2-3% of the investment)

- Success fee for startups (usually 2-3% of the investment)

- Profit-sharing from investors (usually 20% and on a deal-by-deal basis)

- Advisory equity from startups for facilitating the funding (usually 2-5% of the raised amount)

There is nothing networky about this model, as the costs add up quite quickly for investors, as I figured out below:

These costs do not include any deal-by-deal carry or the facilitation equity charged to startups, which boost the network’s promoters’ profits, but will yield lower realizations to investors. Here is a link to Fred Wilson’s spreadsheet explaining the difference in net returns for investors between fund carry and deal-by-deal carry.

Therefore, calling a spade, a spade, India’s current angel networks operate as a hardcore investment banking business.

A traditional network should remain non-profit for the investors and run by investors. That the angel investment business alienated superangels into setting up independent investment vehicles was captured well in Sriram’s article: There is a shake-up in angel investing, and legacy angel networks are struggling to adapt. (I got quoted in it too)

I am clear that there is absolutely nothing wrong with starting, operating, and managing startup investment platforms. These platforms organize much-needed capital from passive investors who may not have the resources (time, network, experience, or money) for making venture deals.

I have invested through such platforms and have discovered some fantastic companies through them. It is a sound business model, and super successful ventures as MicroVentures, EquityZen, OurCrowd, or iAngels founders will tell you.

However, these platforms are obvious in that they are for-profit models. They have obtained licenses to pool investments (as required in their countries of operation), and investors investing or startups raising from them know the exact costs they are paying.

As I have known them, the real angel networks are well and truly dead – at least in India.